High street bank profits hit as savers shift their hard-earned cash to higher interest rate savings accounts

- Brits moved millions from their current accounts to new or existing savings pots

Canny savers are shifting their hard-earned cash to higher interest rate savings accounts in a blow to High Street banks.

Profits have been hit as Britons have moved millions from their current accounts to new or existing savings pots to make the most of better returns.

NatWest said last week that its earnings had been knocked by a drop in its ‘net interest margin’ – the difference between the interest it pays out on saving deposits and the interest it makes from loans such as mortgages.

The Mail on Sunday and others have been urging savers to hunt around for better deals after the end of more than a decade of rock-bottom interest rates – and it seems that people are following the advice.

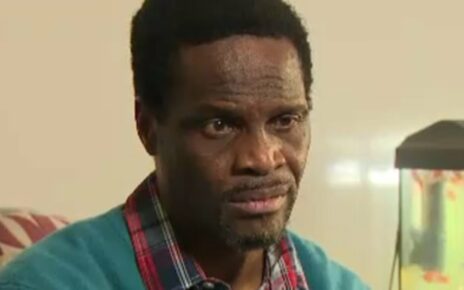

Profits have been hit as Britons have moved millions from their current accounts to new or existing savings pots (stock photo)

NatWest said last week that its earnings had been knocked by a drop in its ‘net interest margin’ (stock photo)

Recent research from Investec shows that interest rate rises on savings accounts have prompted three in every five savers to shop around for the best possible return. Half have already taken action and moved an average of £17,360 into other accounts.

Last month after 14 consecutive rises the Bank of England left the interest rate unchanged at 5.25 per cent. But financial institutions can set their rates much higher than that. Building society Nationwide, for example, now offers a savings account with an eight per cent interest rate for the first year.

Britons are also moving to better-paying current accounts. Almost 1.4 million switches took place in the year to September 30, a rise of almost two-thirds compared with the previous year, according to data from Pay.UK.

Source: Read Full Article